Furniture sales are booming, but unlike with other industries they’re overwhelmingly still happening in store.

According to Forrester, the US furniture market is expected to be worth over $130 billion year, making it one of the strongest performing categories, trailing only clothing, consumer electronics and personal care. Interestingly though, just 17% of furniture sales happen digitally, compared to 40% of clothing and 60% of consumer electronics.

There is a lot of buzz about DTC and its ability to shake up the industry, but when it comes to furniture, customers still want to shop in-store. Even consummate direct-to-consumer brand Wayfair has started opening showrooms.

But this doesn’t mean stores haven’t changed.

“Digital is known for being innovative and moving quickly, but brick-and-mortar is catching up.” said Tulip CEO, Ali Asaria. “As a result, there’s a widening gap between retailers who are designing the physical experience around today’s customers and those are doing it how it’s always been done.”

Here are four ways that modern customers have changed and how top retailers are evolving their stores to keep pace.

1. CUSTOMERS ARE BUSIER THAN EVER

When a customer comes into the store, they don’t want to wait for help or for an associate to go to the back to get answers to questions. Customers expect to have the right person available to help them right away—and they expect them to be knowledgeable.

“Retailers need to plan to accommodate busy customers—and that starts before they even come into the store,” said Asaria. Customers book appointments to go to the salon and to pick up their groceries. Furniture retailers are starting to do the same, allowing customer to pre-book appointments to come into the store straight from their ecommerce site. This lets the store ensure they have an associate with the right expertise ready to go so the customer doesn’t need to wait around.

Even with appointment technology available, customers will still walk in and retailers need to be ready for them. It doesn’t matter if the associate is brand new or specializes in another department, they need to be able to knowledgably guide the customer through the store. While more extensive training might be an option, it’s a lot more efficient for retailers to give associates an iPad with full product details at their fingertips (whether it’s in store or not) so that every associate can answer questions, suggest options and provide background, no matter the question or product.

2. SALES PRESSURE ISN’T TOLERATED

Foot traffic is up, but so is cross-shopping and customers will often visit multiple stores multiple times before making decisions, especially on larger items. Many associates live off commissions, but customers expect the associate to be patient and invested—no matter where they are in their buyer journey.

Each customer has their own buying process, and it usually involves some mix of store visits and online research. Retailers need to ensure that their associates are incentivized to support how customers buy, rather than putting the two parties at odds.

Furniture retailers have traditionally attributed sales to either the first or last touchpoint. This approach de-incentivizes associates to contribute throughout the sales cycle and makes them very wary of directing customers online. It also clouds the big picture and makes it hard to understand the full customer journey and make strategic decisions. Top stores are now using multi-touchpoint attribution to track their buyers across channels and credit associates for their impact throughout the sales cycle, no matter where the sale starts or ends.

3. CUSTOMERS ARE USED TO DIGITAL PERSONALIZATION

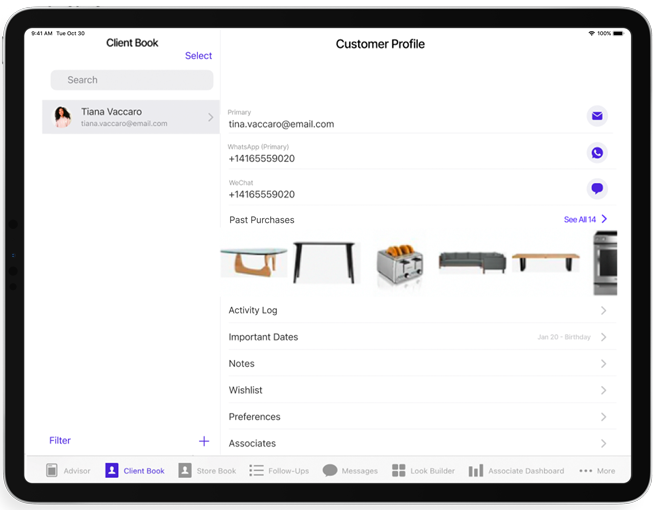

“Customers have gotten used to shopping online and the personalized experience that comes with it,” Asaria points out. “Ecommerce sites know their customers’ names, contextually suggest products, and ‘remember’ details about interactions to provide a better experience.” Fair or not, customers now expect the same experience in-store and get frustrated if they have to give the same information multiple times.

The larger the purchase the more important this is—if customers have sat down with your team and shared colors, dimensions and other details, making them do it again on a subsequent visit is a fast way to build friction and lose the sale. Even for quicker purchases, customers expect their history with the brand to be ‘saved’ and want quick answers to questions like “did I buy these in white or ivory last time I came in?”

A customer record with a name and a phone number doesn’t cut it anymore. Instead, top retailers are starting to build out detailed customer profiles so that associates have one-touch access to everything from kitchen dimensions to fabric preferences and can share information as a team. Some market leaders are even going a step further and pulling in details about a customer’s online cart or wish list to create a fully seamless experience.

4. OMNICHANNEL IS THE NEW STANDARD

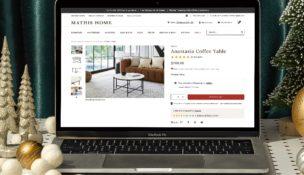

While online-only customers are a minority for home and furnishing retailers, so are pure brick-and-mortar customers. The vast majority do some research online, come into store to vet options and bounce back and forth between the digital and physical throughout their lifetime. As a result, associates are no longer just responsible for what goes on within the four walls of the store and instead need to serve as guides through the complete customer journey.

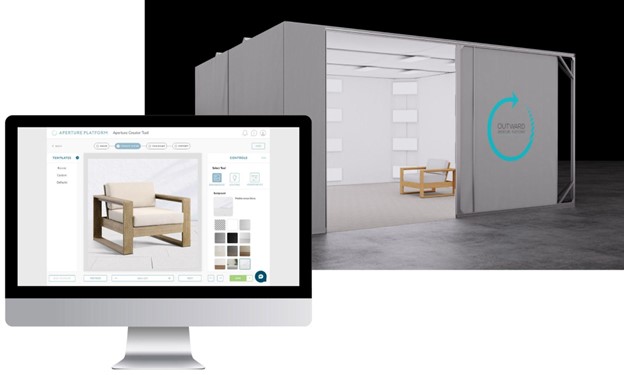

Part of this has to do with bringing the digital experience into the store. A swatch book is great to feel textures, but customers also want to be able to see models, colors, or variations that aren’t in the showroom. The best way to do that is usually digital. A much bigger part has to do with extending the guidance offered in-store to support the fuller omnichannel relationship. Something as simple as texting a customer a link with the items they’re considering, can often make the difference between a customer that progresses towards a transaction and one who falls off.

PUTTING IT ALL TOGETHER

For much of retail’s evolution, this kind of interconnected store seemed like a pipe dream. It made sense on paper but was nearly impossible to roll out at scale, at least not without tremendous resources. A big part of this comes down to how difficult traditional store systems made it to evolve.

“Tulip’s mission has always been to change that,” said Asaria. “All of our solutions are cloud-based, they run off iPads, and feel simple to use—but they’re also really powerful and are mission-critical systems for some of the top retailers in the world as well as some of the fastest growing.”

It used to be that every store had a big clunky point of sale, employees had to source information out of product books and customer binders, and process had to be manually enforced. In short, the experience was what it had to be. Companies like Tulip are changing that with solutions that let retailers be nimble and responsive to their customers.

“If we know one thing, it’s that customers are going to keep changing,” said Asaria. “We need to be ready to respond.”

Learn more about Tulip or join us for a webinar about how top furniture retailers are connecting with their customers.