MIDVALE, Utah – On the upside, the relaunched Bed Bath & Beyond platform has pulled in more than 300,000 new customers. But while related metrics are improving, Overstock.com Inc. net revenue still fell by double digits.

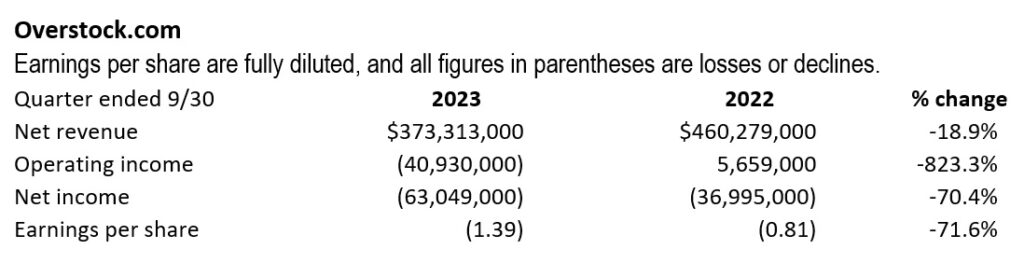

For the third quarter ended Sept. 30, total net revenue fell 19% to $373 million. The company posted an operating loss of $41 million vs. operating income of $5.66 million in the year-ago quarter. Net loss was $63 million, or $1.39 per diluted share, compared with a net loss of $36.99 million, or 81 cents per diluted share, in last year’s Q3.

The company ended the quarter with $325 million in cash and cash equivalents.

During the first month of the quarter, the platform was still operating under the Overstock.com banner. The site transitioned to the Bed Bath & Beyond brand on Aug. 1.

Company CEO Jonathan Johnson stressed that the business is still in the early stages of capitalizing on its transition to Bed Bath & Beyond. “We have been successful in acquiring new customers and reactivating past customers. Total active customers grew sequentially over two years,” he said.

Although revenues were still down, orders returned to positive year-over-year growth the for first time in more than two years, he noted.

Key operational metrics included:

- Orders delivered up 3% to 1.9 million.

- Active customers of 4.9 million, down 15%.

- Average order value of $192, down 9%. This, in part, reflects the greater ratio of lower-priced soft home and housewares goods in the mix to reflect the legacy Bed Bath & Beyond assortment.

- Orders per active customer of 1.48, a decrease of 9% year-over-year

“It’s taken longer to warm up the (legacy Bed Bath & Beyond) email file than we hoped. We took some time because wanted to make sure we didn’t have any email caught in spam files,” said Johnson.

See also:

- It’s back! Beyond reintroducing liquidation model with familiar name

- Overstock steps Beyond its past in corporate rebrand

- Overstock overhaul? Hedge fund pushing for action