What Is Recommerce?

Recommerce, or resale, is a way to power the reuse of goods — from fashion to furniture to fitness equipment. It’s enabled through the marketplaces where merchants, brands and consumers sell or purchase and rent secondhand goods, and through the technology and logistics solutions designed to support these processes.

Recommerce isn’t a new concept, but lately, there’s a lot happening in this area of the “circular economy” that’s benefiting both brands and consumers:

- More brands are seeing this fast-growing market as a strategic opportunity to meet multiple, business-critical goals — namely, overcoming supply chain challenges, reducing waste, increasing consumer brand loyalty, and, of course, generating revenue.

- Many consumers are benefitting from recommerce by buying quality products from stellar brands at lower prices than what they’d pay if they purchased those items new. They’re discovering new brands and products in the process, too. Plus, they’re getting the satisfaction of engaging in environmentally responsible consumer practices.

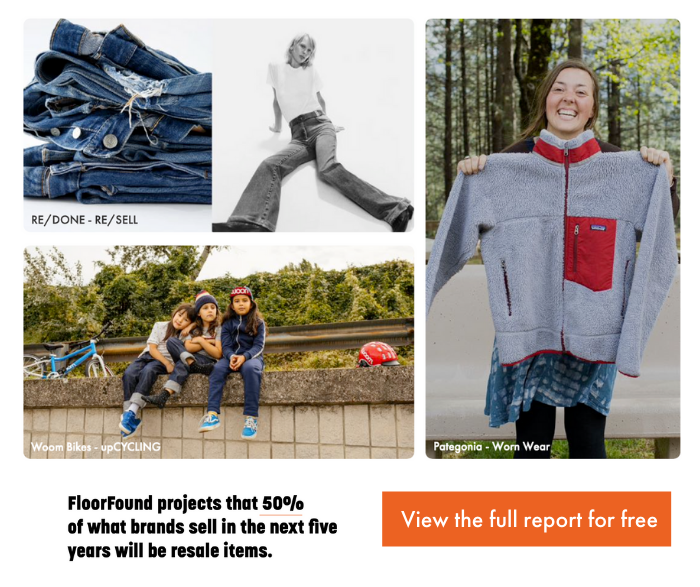

The apparel industry is already finding tremendous success with the recommerce model. And recent research suggests that the resale sector of this industry is expected to grow 11x faster than the broader retail clothing sector by 2025 — reaching $77 billion.[1] According to that same research, 33 million people purchased secondhand apparel for the first time in 2020, and more than three-quarters of them (76%) are planning to increase their spend on resale in the next five years.[2]

At FloorFound, we’re so confident about the recommerce market’s growth potential that we project 50% of what brands sell in the next five years will be resale items. In this paper, we present results from the “FloorFound Consumer Survey 2021,” which help to underscore why we have such a positive outlook toward recommerce, especially for the resale of oversized items online.

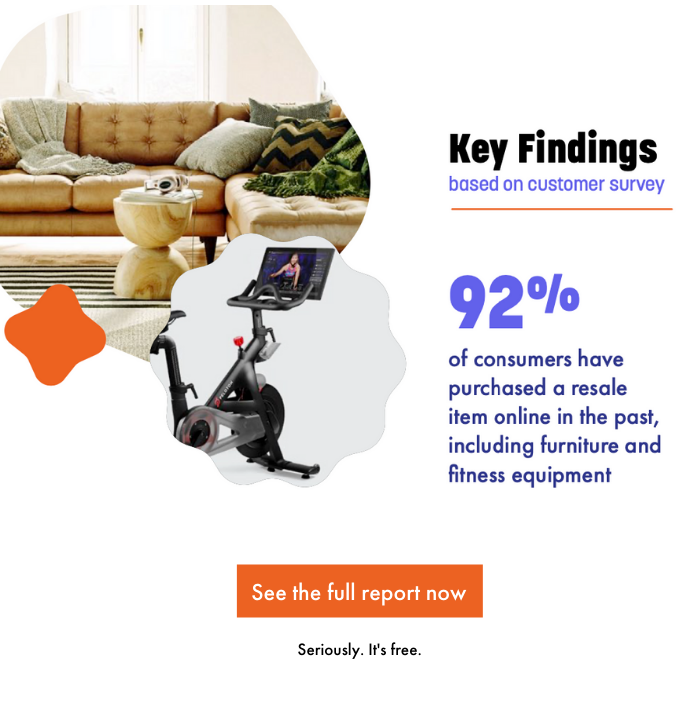

Our key findings from the survey include the following:

- 92% of consumers have purchased a resale item online in the past, including furniture and fitness equipment

- 95% of consumers would be open to buying resale items from brands directly at a discount

- 88% of consumers are interested in working with a brand that provides a trade-in program

Let’s take a closer look at these and other findings from our recent survey of U.S. consumers —conducted by Pollfish in July 2021 — and why we think now is the time for brands to develop their recommerce strategy.

FloorFound projects that 50% of what brands sell in the next five years will be resale items.

Why Recommerce Now: Consumer Perspectives

Most consumers are already on board with recommerce. In 2020, 223 million consumers said they shopped for secondhand products or would be open to doing so.[1] And in the “FloorFound Consumer Survey 2021,” 92% of U.S. consumers said they have already purchased a resale item online.

What are they buying…

Download the full report to learn what oversized items consumers are already purchasing and why.

You will also learn how recommerce is benefiting early adapters, including the results of Floyd, a Detroit, Michigan-based furniture manufacturer. As well as how brands overcome the hurdles that might hold you back.

[1] 2021 Resale Report, ThredUp, featuring research and data from retail analytics firm, GlobalData, June 2021: https://www.thredup.com/resale/#resale-industry.

[2] Ibid.